Federal Deposit Insurance

Your deposits are protected.

The federal government insures your deposits through the National Credit Union Administration.

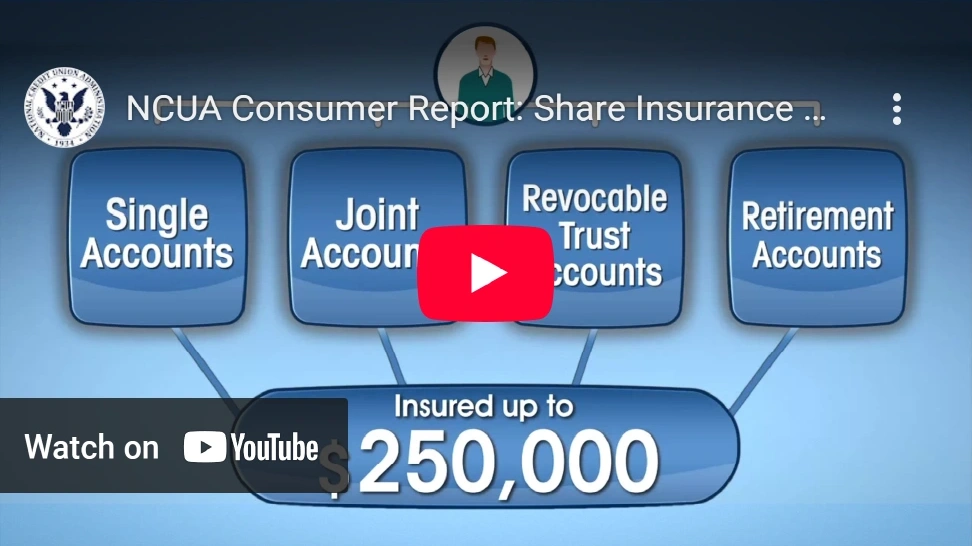

Just as deposits in banks are insured by the Federal Deposit Insurance Corporation (FDIC), deposits in credit unions are insured by the federal government through the National Credit Union Administration (NCUA).

Coverage

- All of your individually owned savings and checking accounts (e.g., savings, checking, Christmas Club, certificates, and money markets) in Summit Credit Union are cumulatively insured up to $250,000

- A separate $250,000 in coverage is available for other cumulative checking and savings accounts when they contain the same joint owner(s)

- Funds in Payable On Death (POD) accounts are insured for a separate $250,000 for each beneficiary

- The cumulative funds in your IRA accounts at Summit are also separately insured up to $250,000

By combining different types of accounts and different owners, you can maximize your coverage to receive more than the base $250,000.

Find Out More

Deposit insurance can get confusing. Learn how the NCUA protects your money on the NCUA Share Insurance Resources page.

Summit Credit Union is a full-service financial institution with eight branches throughout North Carolina.